The Incoterms (or International Commercial Terms) are a series of predefined commercial terms published by the International Chamber of Commerce every 10 years and relate to international commercial law.

Now that the UK’s customs platform CHIEF is being replaced by CDS, Incoterms have become more important than ever; we now have to declare them on CDS entries.

What are Incoterms?

Proposed, updated, and copyrighted by the International Chamber Of Commerce (ICC), Incoterms serve as global standards for uniform interpretation of common contract clauses in international trade.

Your Incoterm will be what has been negotiated between your customer/supplier and you when you agreed to buy or sell the goods being transported.

How do they impact us?

The terms show us who is responsible for what in terms of Risk and Financial Liability/Responsibility.

This includes -

- Who is responsible for transport costs

- Who is expected to complete import/export declarations and pay the duties

- Where the transfer of ownership will take place

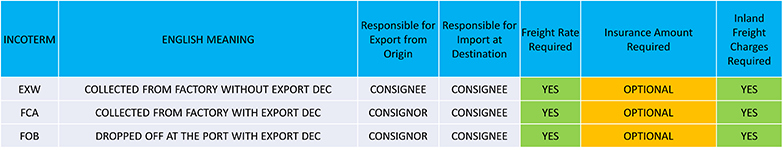

SET 1: ORIGIN (E & F Rules)

EXW – Ex-Works

FCA – Free Carrier Alongside

FOB – Free On Board

These three are all based out of origin.

We are required to declare freight charges on E and F rules, so we will require both origin costs and destination freight costs separately.

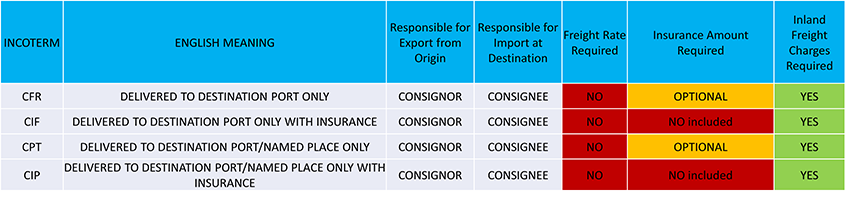

SET 2: C RULES

CFR – Cost and Freight

CIF – Cost, Insurance and Freight

CPT – Carriage Paid To

CIP – Carriage and Insurance Paid To

These three are all based on the destination port/named place. In road freight, these are often confused for DAP.

Please note: destination is named place and NOT place of delivery.

As with E and F rules, we are required to declare freight charges on C rules, so we will require both origin costs and destination freight costs separately.

Where we need origin costs and destination freight costs on E and F rules, C rules require destination freight costs. C rules are all based on the destination port/names place (NOT place of delivery), and in road freight they are often confused for DAP.

SET 2: D RULES

DPU – Delivered at Place Unloaded (2020 Rule)

DDU – Delivered Duty Unpaid (2010 Rule)

DAP – Delivered at Place

DDP – Delivered Duty Paid

Please note - D rules incur no freight costs.

For more information, contact one of our customs experts today.