Please note, this page is a technical guide to the ATA Carnet process. To learn what ATA Carnets are, whether they are right for your business and how we can help, visit our ATA Carnet Passport for Goods guide.

If you are temporarily taking goods out of the UK, then you need to have an ATA Carnet.

Sometimes referred to as a 'passport for goods', an ATA Carnet is an international document that allows the temporary export and import of non-perishable goods for up to one year. This includes things such as tools of the trade, exhibition equipment and commercial samples.

Consumable items such as food, seeds etc, explosives and disposable items are NOT covered.

For more information, visit the Gov.uk 'Get an ATA Carnet' website.

Need an ATA Carnet? Contact us for a price estimate

Here is an example ATA Carnet and an explanation of what every section of the document means.

ATA Carnet Document Explanation

1.

We have prepared this ATA Carnet according to your instructions and it has been carefully checked. Please verify that there are no inaccuracies or deficiencies (and report to us immediately if there are any problems). Alterations can only be made before the Carnet is used and must be endorsed by the HMRC. Please read the notes on the inside back cover of the Carnet. The front cover must be signed by the holder before use (box J)

Declarations in Section F on all vouchers must only be made in front of the relevant Customs. Please note that if the Carnet is being handled by your agent/freight forwarder you must ensure that you have provided them with written authorisation to act on your behalf. It is also advisable that you obtain a counter-indemnity from your agent to protect you against foreign Customs claims in case the document has been used incorrectly.

2.

Now this Carnet has been issued, the list of goods shown on the back of the green front cover (General list) cannot be amended in any form whatsoever. Failure to comply with this regulation will mean delay in the discharge of the Carnet and will incur a regularisation fee. Any deviation from the goods shown on the General list to those actually being transported must be noted by HM Revenue & Customs in column 7 of the General list and duly stamped. No additions are allowed. Please remember to make photocopies of the loose set of attached list (if applicable) as per the number of vouchers before using this Carnet.

3.

The green front cover (UK Customs shaded Certification box) and the yellow exportation counterfoil must be endorsed and the voucher detached by UK Customs. Both the ATA Carnet and the goods must be presented to UK Customs. However if the point of exit from the EU is in another member state, UK Customs will complete the front cover and remove the yellow voucher, but the counterfoil (box 7) will be completed by customs at the point of exit from the EU. If UK goods are held in another Member State, a UK ATA Carnet can be issued. To ensure that Customs in the Member State where the goods are held will authorise the Carnet and process the Carnet either as the office of export or exit, you must check with them in advance.

Some UK Customs offices of export or re-import do not have 24hr public service. To ensure the availability of a Customs Officer at your office of export or re-import, for the endorsement of your documents, contact HMRC General Advice Line on 0300 200 3700 at least two working days prior to your intended departure. They should be able to provide you with a time when a Customs Officer will be available for the endorsement of your Carnet at your office of export or re-import.

4.

All the sheets in the Carnet are numbered in sets 1 onwards and you are advised to make certain that the correct pair is used for each country visited. It is imperative that both the white importation and re-exportation counterfoils are stamped and show which items have been cleared. Customs border posts are often not always open 24 hours per day for processing Carnets and you are strongly urged to check in advance that the Customs will be available when you intend to cross frontiers.

5.

It is essential that entries and exits from one country to another are properly certified by the relevant Customs. Failure to obtain the correct verifications of entry and exit from each country visited will result in a claim and you may be required to pay Customs Duty, Tax and / or Penalty. Regularisation of any irregularity will delay discharge of this document and the security lodged will not be returned for up to 21 months from the expiry date of the Carnet.

6.

You must comply with any time limits imposed by Customs of the countries of temporary importation. E.g. foreign Customs may impose a time limit for re-exportation that may be less than the overall validity period of one year. This will be shown in section 2 of the importation and / or Transit Grouped counterfoils. If the time limit is exceeded, Duty, Tax and / or Penalty charges will apply despite proof that the goods were eventually re-exported.

7.

The completed yellow re-importation voucher and goods must be presented at the Custom office of entry back into the UK or another EU Member State. The Carnet and goods do not need to be presented on entering or leaving other Member States, while in transit back to the UK. It is imperative that the re-importation counterfoil is stamped and shows which items have been cleared.

8.

This Carnet must be returned to the office of issue intact, at the latest on its expiry date. Please ensure that photocopies of any Customs endorsed pages are kept on your files in case the Carnet gets lost en route to the issuing office. Missing Carnet, sheets and / or counterfoils will delay the discharge and return of the associated security lodged.

9.

It is imperative that the Carnet number is referred to in all communications and for this purpose please retain a record of it on your files. Without this number we are unable to confirm the status of your file and associated security.

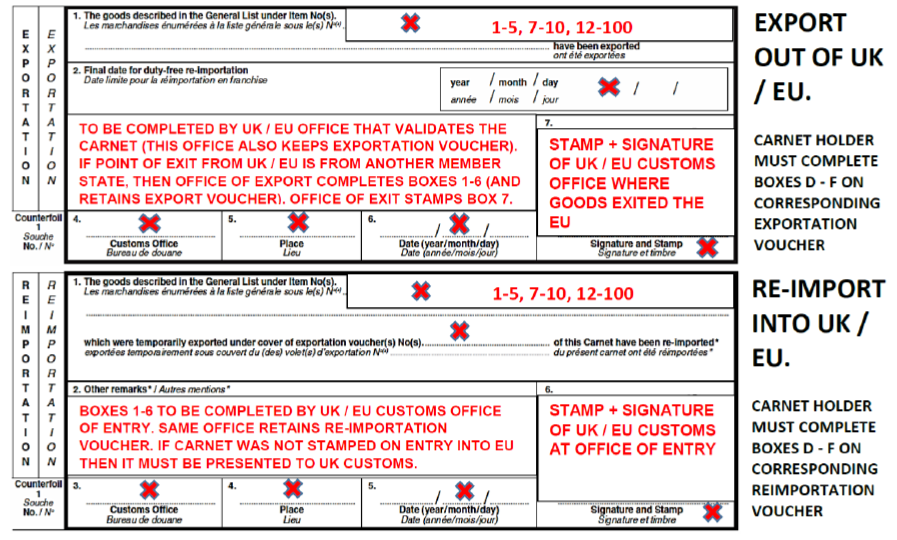

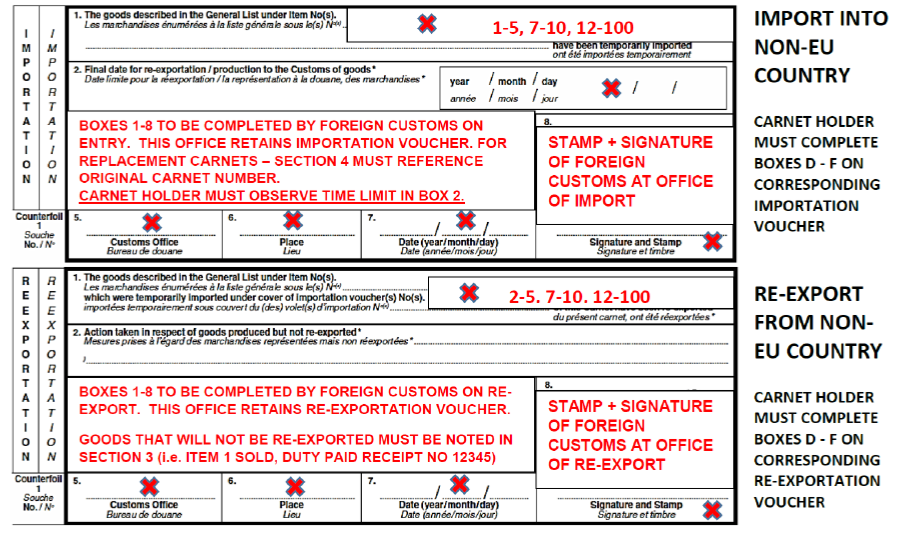

Examples of How the Carnet Should be Stamped by Customs

Counterfoils for Completion by UK/EU Customs

Counterfoils for Completions by Foreign (non-EU) Customs

If you have any questions about ATA Carnet and your requirements, contact our team.